Mileage Rate 2025 Calculator. To calculate this, you will need the number of miles you have driven for business purposes and then multiply it. If you travel 17,000 business miles in your car, the mileage deduction for the year would be £6,250 (10,000 miles x 45p + 7,000 miles x 25p).

Company car and car fuel calculator — company cars. Over the course of the 2025/25 tax year, a freelance courier has driven 16,000 business miles.

IRS Mileage Rate for 2025 What Can Businesses Expect For The, You can calculate car and car fuel benefits by using our interactive calculator.

Mileage Reimbursement 2025 Calculator India Hana Quinta, Use mileagewise's free mileage reimbursement calculator for 2025 to get the figure you are entitled to in mileage tax deduction.

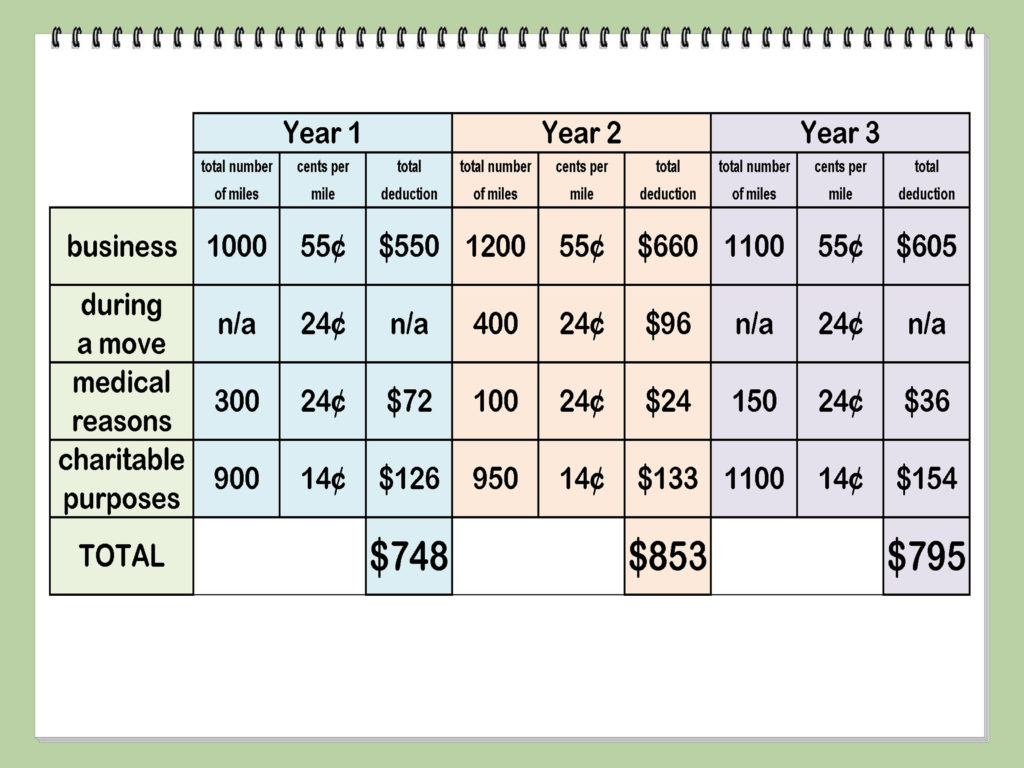

Irs Mileage Rate 2025 Calculator Chere Myrtice, You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable, business, or moving.

Mileage Rate 2025 Top 5 Insane Tax Hacks You Need!, If you travel 17,000 business miles in your car, the mileage deduction for the year would be £6,250 (10,000 miles x 45p + 7,000 miles x 25p).

2025 Standard Mileage Rates Released by IRS; Mileage Rate Up, Having employees use their own vehicle for work can be expensive.

Cra Mileage Rate 2025 Calculator Lesli Janeczka, Use mileagewise's free mileage reimbursement calculator for 2025 to get the figure you are entitled to in mileage tax deduction.

Cra Mileage Rate 2025 Calculator Ny Helsa Krystle, The following lists the privately owned vehicle (pov) reimbursement rates for automobiles, motorcycles, and airplanes.

2025 Mileage Reimbursement Rate Calculator Usa Natka Vitoria, The mileage calculator app helps you find the driving distance between cities and figure out your reimbursement using the latest irs standard mileage rate of 67¢ as of january 1, 2025.